2012 is

nearly done and dusted. Time to take a break and start afresh in the new

year.

Maybe not!

There have been some significant developments

within the National Treasury this year, as confirmed by Pravin Gordhan’s Medium

Term Budget Policy Statement to parliament last month. Furthermore, Gill Marcus

has left little to the imagination in the Reserve Bank statements.

2013 will be a tough year.

How does it affect

investors? And what trends can we take forward into

2013?

Lesson 1: SA government struggles to

collect enough taxes

Gone are the glory days

of Finance Minister Trevor Manuel, when tax collections increased by 12% per

annum from 2003 to 2008. Most of this was achieved through growth rates of above

4% and inflation rates above 6%. Growing SARS' efficiency and tightening up tax

legislation also helped.

Today, Pravin Gordhan faces a very different

challenge. Growth rates have declined to 2.5%, and the SA tax base cannot be

broadened without a substantial increase in tax rates or the imposition of new

taxes (for example, carbon emission taxes).

The National Budget Speech in

February 2013 will be a very interesting event.

Even if SARS achieves

its 2012/13 budgeted tax collection target, it would seem the National Treasury

will need even more during the 2013/14 tax year. Where will National Treasury

find another R100 billion a year to keep SA on track?

Based on certain

trends identified in the SARS Statistics 2012 (released in October 2012),

increases in corporate tax rates seem unlikely as the principal problems are

lower corporate earnings and assessed losses brought forward from the financial

crisis of 2008/9.

A VAT increase is the obvious answer, but this would

not be received well by organized labour and will probably be

avoided.

This leaves personal income tax increases as the only real

alternative for National Treasury. The question is rather: ‘what form will it

take?’

Will National Treasury attempt to increase the super-tax level

above 40% on taxable income above R617 000 per annum? This is unlikely as there

are simply not enough super-tax taxpayers to make a substantial

difference.

Will Capital Gains Tax inclusion rates be increased?

This possibility cannot be ignored. But this would be more a measure to contain

reduced collections from CGT (now only about R6 billion per annum) rather than

generate a new source of income.

Or, will the shortfall be made-up by

simply containing the tax-relief granted to all taxpayers? Yes, that is probably

the only realistic alternative.

The pressure is on for SARS to find more

options. This, coupled with the implementation of the new Tax Administration

Act, will mean that penalties and interest charges for the errant taxpayer will

be a very unpleasant experience. And there is little that even the most

brilliant tax specialist will be able to do to try and get these charges waived

or reduced.

For the investor this means that when considering any

investment it is critical to ensure that the manager can report tax information

timeously and accurately.

Other tax

factors are becoming equally critical. ‘The quality of the income’ has become

increasingly important.

- Is it fully taxable revenue income or partially

taxable capital income?

- What type of taxpayer receives the income?

- Is it a company, an individual, an insurance

policy or a trust?

The playing

rules in this arena have changed in recent times and should be regularly

reviewed when placing investments.

Lesson 2: The SA government

cannot borrow its way out of trouble

Pravin

Gordhan is almost permanently at war with international rating agencies

regarding SA’s credit and investment status and resultant

ratings.

Critical in this debate is the extent of SA’s fiscal debt.

Simply put, the national deficit cannot be allowed to increase above 4% of Gross

Domestic Product.

The knock-on effect is that the Reserve Bank is under

enormous pressure to contain interest rates at current levels as government

itself would not be able to absorb the increased interest costs without

increasing national debt.

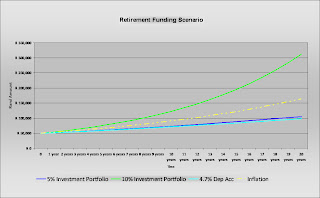

Current after-tax interest yields are below

inflation and likely to remain so for the foreseeable future.

The result

is that for the investor to generate any real growth, there has to be an

exposure to equity-based investments. And with that goes the management of risk

profiles of investments. That is a science better left to portfolio

managers.

Lesson 3: Lower interest rates and other factors leave

the Rand

vulnerable

Over the past few years, overseas

investors have propped up SA’s balance of payments current account with inward

investments seeking to take account of SA’s favourable interest

rates.

Recent indications are that international banks will have to

deleverage by $4-5 billion during 2013. There is simply not that much money

around at present and this has already had a substantial adverse effect on the

balance of payments current account and exchange rates against the Rand.

As indicated above, the Reserve Bank cannot

increase SA’s interest rates to attract inward investment to prop up the

Rand.

Even if one ignores SA’s political

risk, the Rand is very vulnerable at present and investors should always be on

the lookout for Rand hedge investments.

Remember, a substantial decline in exchange rates can easily squander a

year of carefully generated returns.

Lesson 4: The debate on

retirement funds is not over, not by a long

way

On paper other investment vehicles simply

cannot currently match the tax profile of retirement funds. Where else does the

investor enjoy a tax-deductible contribution, followed by tax-free growth and a

partially taxable withdrawal?

But this

could all change.

Currently, there is a range of proposals released by

National Treasury for public comment. At the very least this will lead to

capping of tax-deductible contributions with effect from the 2014 year of

assessment.

Investors are reminded that for the 2013 year of assessment,

contributions to retirement annuity funds are only limited by the 15% of

non-retirement funding rule.

Over the next few years there are sure to

be changes affecting preservation requirements and investment allocations within

retirement funds. Certainly current concessions granted to living annuities and

Regulation 28 of the Pensions Fund Act are bound to receive

attention.

There is bound to be much speculation on the final outcome of

the National Treasury proposals. The only sure way of containing risk to change

is through diversity of investment vehicles.

Lesson 5: The residential property

market has not recovered

Back in 2008 American

economists Carmen Reinhart and Kenneth Rogoff made news with their publication,

‘The aftermath of a financial crisis’. At the time they predicted that it would

take seven years for residential property markets to recover.

At present

there has been little recovery in the residential property market and there are

few commentators who can sincerely suggest that good times are just around the

corner. Some say the recovery of the residential property market will take a

decade, others have even suggested a generation.

Meanwhile, the holding

costs of residential property have skyrocketed to the extent that some are

wondering whether residential property is an asset or liability.

Many SA

investors are ‘overweight to residential property’. And perhaps the time has

come for many to cut their losses rather than attempt to ride out the

market.

Lesson 6: The new energy crisis is here

to stay

It seems plain crazy that SA

celebrated when the 2012 Eskom increases were contained at below

20%.

Although oil prices dipped below $100 a barrel in the early part of

2012, it did not last long. And the recovery of oil prices, coupled with a

weakening exchange rate has taken fuel prices back to R12 a liter.

The

Gauteng fuel

debacle is not yet over and the resultant loss to National Treasury is running

at R5 billion a year. Pravin Gordhan is going to have to recover the position by

way of a massive increase in fuel levies with effect from 1 April

2013.

South Africans will be lucky if energy cost increases for 2013 are

contained at below 20%.

An integral part of financial planning is to

contain expenditure. It would seem that even a Ponzi scheme would struggle to

outperform the expected increase in energy prices.

With US

President Barack Obama now safely back in the White House, his first challenge

is to address the ‘fiscal cliff’. What will the US do to contain

its staggering national debt? And with Republican and Democrat

America now completely

divided on the issue, this has every potential to push the US back into

recession during 2013.

The effect of a US recession

would have a massive impact on all investors. This is no time to take risks.

Investment strategy is not so much about how much is made in good times

but rather how much is not lost in bad times.

Article written by: Matthew Lester, Professor of Taxation Studies