First we

need to specify a few assumptions. The first of which being that a 1% annual

management fee is charged on both the investment solutions (in other words, we are ignoring the monthly account fees that are charged on a notice deposit

account). Secondly, we assume that inflation is a constant 6.1% per annum – although we all know that actual

inflation is much higher as we are not exactly big end users of paraffin and staple

foods. Third, the rates of return are the average over full 12 month (1 year)

periods.

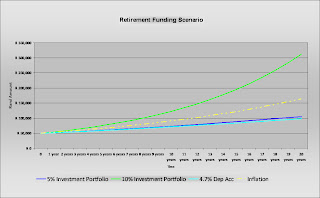

Ok, let’s have a look at how an interest bearing deposit account -

from no bank in particular - that earns 4.7% per annum compares against

Inflation.

Very

clearly, it under-performs inflation rather badly. In other words, as time goes

by, the ‘buying power’ of your money is decreasing. So you are becoming

progressively poorer over time.

The next step is to compare Investments that grow at 5% and 10%, to

both inflation and what is essentially a savings

account.

What we

notice here is that although the 5% Investment Portfolio – being an investment

portfolio that grows at an average of 5% per annum – out-performs the 4.7%

deposit account, it still under-performs inflation by some margin. What stands

out though, is that if the average annual growth of the investment portfolio is

10%, then the performance far outpaces inflation. This is when real capital

gains are made; i.e. when capital grows faster than inflation and the

deteriorating effects of inflation are negated. In this particular scenario, the

‘real return’ would be the difference between the investment return – being 10%

- and inflation, which works out to 3.9% (Note that the real return for the

deposit account is in actual fact -1.4% - meaning that you become 1.4% poorer

each year).

When we look

at the past performance of the Trading/Investment Model that is used to manage

our Investment Clubs, we see that over the last 3 years, they have returned a

cumulative 115% over that 3 year period (9.4%

in 2010, 46.8% in 2011 and so far 34.37% [annualized] in

2012). Fair

enough, we cannot guarantee that we will continue to double our investor’s money

every 3 years, but we can say that we aim to attain an annual growth of 15% –

25%, which as we are sure you will notice, is a lot more than the 10% example used

above.

We hope that

you have found the above both helpful and informative.

No comments:

Post a Comment