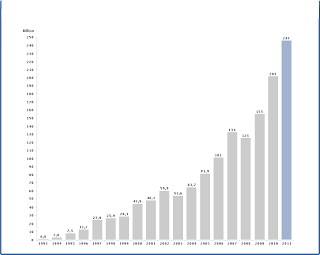

With over R 247 Billion under management and a firm growth trend in place, Coronation Fund Managers is a force to be reckoned with. Currently trading at R30.05, we see a lot more value in this share. Coronation is actively and aggressively growing its market share in the fund management business and will likely offer great returns to its shareholders in both the medium and long term.

|

| Coronation Fund Managers assets management 1993 - 2011. Source www.coronation.com |

Having already added just over 50% to its share price in the last 12 months, we believe that the best is yet to come with the fundamental value of the company being somewhat higher than what it is trading at present. According to our evaluation model, its current price should be R34.40 with a dividend yield of 5.7%. Clearly then, it is trading at a discount of 12.6%.

|

| Coronation Fund Managers - Weekly Chart |

Looking at the chart above, it is clear that there is a strong long term trend in place and that good buying opportunities present themselves from time to time. Such an opportunity is fast approaching in the coming weeks. There is the potential for some resistance (possible double top), however the presence of a hammer formation on a support level and a moving average provide reassurance that the trend is in place and will continue it's upward path to spite the mild resistance.

|

| Coronation Fund Managers - Daily Chart |

When we look at the daily chart, the picture becomes clearer. With a support level at R29.00 that looks as if it will line up perfectly with the area between the two 'buying zone' moving averages, it seems that the time to buy is close at hand.

No comments:

Post a Comment